Measuring a brand’s value begins with conducting a brand equity study.

If someone were to ask you what is the hard value of your company, it’s property, or even the annual year-over-year sales were, you’d likely be able to tell them with supporting numbers in hand. Yet, if you were asked how much your brand is worth and how much equity it has, chances are you wouldn’t be so certain.

In this post, we will combine the expert perspectives of marketing mastermind David Aaker and branding heavyweight champion Kevin Lane Keller. We will discuss statistical techniques, ways to improve your marketing strategy, and how to determine your brand’s equity.

Brand equity is important to many companies because it has a direct impact on business outcomes such as sales and market share.

The sheer amount of pressure to become data-driven could crush anyone’s creative ambition if they are not naturally analytically-minded. Yet, to succeed in digital marketing and establish a fair balance between short-term revenue and long-term brand building, operating with a data-first strategy is no longer a nice to have, it’s a must.

Brand Equity

“Brand equity is a set of brand assets and liabilities linked to a brand, its name, and symbol, that add to or subtract from the value provided by a product or service to a firm, or to that firm’s customers,” says Aaker in his 1991 book Managing Brand Equity.

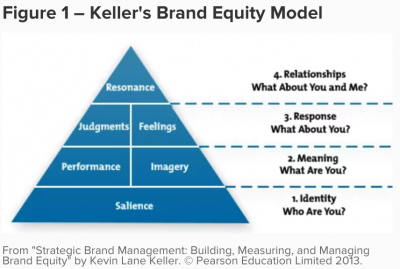

The following seven elements comprise brand equity, according to Dartmouth College Professor Kevin Keller:

- Be perceived differently and produce different interpretations of performance

- Enjoy greater loyalty and be less vulnerable to competitive marketing actions

- Command larger margins and have more inelastic responses to price increases and elastic responses to price decreases

- Receive greater trade cooperation and support

- Increase marketing communication effectiveness

- Yield licensing opportunities

- Support brand extensions

Aaker’s assets and liabilities can be grouped into the following core areas, which all stem from your name/symbol and play a major part in a brand equity study:

- Brand loyalty

- Name awareness

- Perceived quality

- Brand associations in addition to perceived quality

- Other proprietary brand assets — patents, trademarks, channel, relationships, etc.

Aaker states that in addition to these groups, you also have dimensions around what value the brand provides to customers and what value your brand provides the company.

| Brand Value to the Customer | Brand Value to the Company |

|

|

Adapted from Managing Brand Equity, David Aaker, 1991.

“Brand equity, like most constructs, has been defined and measured in numerous ways. It is sometimes understood from the perspective of tangible financial assets of a firm. However, from a marketing research perspective, brand equity,” says Keller.

Measuring Brand Equity in 6 Steps

Truthfully, measuring the value of your brand is going to take time — you need to gather market research over a period of at least a few months for results that will actually be worth something. So don’t commit to a brand equity study if you need an overnight answer.

- Get a concrete perspective of brand equity throughout your organization. Since brand equity can be viewed from many different perspectives, a boundary needs to be set in stone around financial outcomes and price premiums. Put simply, how much more will your customers pay for your products and services over competitors’?

- Set research goals. For market research that sets out to gain a better understanding of brand equity, there are three common goals that companies choose to focus on, according to Gigi DeVault of The Balance:

- Tracking

- Exploring change

- Extending brand powerRegardless of your goal here, if you choose to focus on one of the three above, ensure that you stick to it so that you remain aligned with what you set out to do and what you are seeking to achieve from the research.

- Know how customers feel about your brand like the back of your hand. While it seems like a trite statement and even cliche, you must know the good, the bad, and the ugly of your customer’s emotional reaction to your brand. Knowing this data will help connect their feelings with your brand, help provide direction for improving brand quality, and increase (hopefully) brand loyalty.

- Identify what you’re going to measure. Pick attributes that are closely aligned with consumer experience such as awareness and reach.

- Perceived brand differentiation. Think brand loyalty here and how confident (or not) your customers are in your brand. This is usually the strongest while a customer is using your product. The beauty here is that you’ll have plenty to measure from using social media channels as your core source of useful data that stems directly from your customer.

- Commit to qualitative and quantitative approaches in gathering brand equity data. This is in Alchemer’s wheelhouse and where we help companies build their brands the most. From using focus groups and panels to providing a “community” of sorts where customers can go and exchange perceptions and individual motivations (online forums, for example, or closed Facebook groups) help tremendously build data both qualitatively and quantitatively.

During this step, we advise many of our customers to conduct a conjoint analysis with their target audience. Similar to the entire process described here, conducting a conjoint analysis takes time not only to administer but to analyze the data gathered from the process.

A conjoint analysis can help the market researcher learn:

- What customers will value most out of the product or service

- What features and functions to prioritize based on the customer feedback (what the company sees as a big shiny new feature may not necessarily be what the end user finds the most useful to them in their everyday use of the product or service)

- What trade-offs customers are weighing when deciding to purchase the product or service

- How to holistically measure features and functions in a side-by-side comparison

In a recent benchmarking report conducted by Bynder, a top challenge for marketers is adapting to changing consumer behaviors. Keeping pace with the hyperbolic habits of human beings in the marketplace, gathering critical and potentially business altering insights depends on tapping into company’s buyer personas to understand their ideal target.

With over 30 percent of respondents to the Bynder study stating that new customer acquisition is a top priority, the case for investing in research around brand equity is that much more paramount for success.

The time has never been more optimal to invest in conducting effective market research, especially, for the sake of your brand’s actual and perceived value.